Are you planning to invest in the stock market but don’t know how to buy and sell shares? You’ve come to the right place. This guide provides all the tools you need to start placing your investments in the stock market.

How to Buy and Sell Shares

First and foremost, how do you buy and sell shares? You need an intermediary, which can be your bank, the post office, or an online broker if you decide to invest on your own. Brokers offer user-friendly platforms to trade using CFD instruments, allowing you to buy and sell shares online from home with ease.

Choosing the Right Trading Platform

Here is a list of the best trading platforms you can use to buy and sell shares online. These platforms are regulated and trusted by millions of investors. If you want to learn more about the world of investing, including costs and mechanisms, read on.

Online Trading Stocks: How It Works

To buy and sell shares, you need to identify the company in which you want to invest your capital. This could be an Italian company (such as Juventus) or a foreign company (such as Amazon).

Next, you need to decide on your investment strategy, specifically:

- What type of gain are you seeking: short-term speculation, long-term growth, or dividends?

- What is your time frame: are you planning to buy and sell shares within the day or invest for the long term?

Once you’ve clarified your strategy and objectives, it’s time to take action.

Where to buy and sell stocks

You can generally buy and sell shares online in two ways:

- by using an investment bank;

- by using an online trading platform.

Both options have their pros and cons. At a bank, you have an advisory service to help you choose the best investment according to your budget and level of risk, but you have to pay hefty commissions and don’t have full control over your transactions. If you manage it online through home banking, consider charging a monthly fee in most cases.

With an online trading platform, on the other hand, you decide on your equity investments, for better or worse, but you have full autonomy over your choices and much lower costs to bear.

Best banks to buy online stocks

Many banks equipped in recent years to provide their account holders with a serious and comprehensive service to invest in shares, even independently. The best banks are those with the lowest commissions and the largest number of financial instruments available to buy and sell.

It is difficult to decide which is the most convenient: we will just mention HSBC, Barclays or FinecoBank. Even the best bank to buy stocks, however, still has higher costs than an online broker.

Online trading stocks platforms

Online trading platforms are the most popular choice because they offer free access to the stock market at reasonable costs. The best brokers offer state-of-the-art software with customisable technical indicators that can be used both on the desktop and via mobile apps.

The best brokers offer state-of-the-art software with customisable technical indicators that can be used both on the desktop and via a mobile app, as well as:

- Interesting features such as training materials (videos, ebooks, webinars, courses)

- Copy trading (copying the investments of a professional trader);

- A free practice account;

- The possibility to invest in cryptocurrencies;

- Much more.

All with zero commissions, you only pay the market spread. Here you have a list of the leading trading brokers to try with a demo account.

[wpsm_comparison_table id=”5″ class=””]

Unlike investment banks, the platforms on the table also require a fairly low minimum deposit, allowing many more investors to buy and sell shares with little money.

With most of these brokers you can buy and sell shares in the form of CFDs, derivatives that replicate the value of the underlying stock. This way you can also trade with leverage and speculate on shares both when the price rises and when it falls.

If you are looking for a specific platform to buy stocks you can choose eToro or an ECN broker like Degiro.

How to trade stocks with little money

If you are thinking about trading in the stock market with minimal capital, the almost obligatory strategy is to buy stocks and resell them in search of a profit. Dividends only become attractive with a large starting capital.

The buying mechanism of every trading platform works more or less like this:

- You choose a share to buy or sell;

- You decide on the amount you want to invest;

- set the limit price at which you want to buy/sell;

- you set stop loss and take profit thresholds on your position.

A limit price is defined as a threshold value below the current market price. It is set in case you want to buy or sell a security at a specific value, lower than what it has now. Alternatively, if you want to proceed with the trading of a stock in real time, you can place a market order.

Stop loss and take profit are instead two “safety” thresholds. The first is the price at which you are willing to see your investment fall. If the price of the stock you have bought goes below the stop loss, the broker will sell/buy automatically, limiting your losses. On the contrary, if the price of a stock exceeds the take profit you will automatically sell/buy the stock again.

Once inserted these variables it waits for the broker to carry out the order and when you think opportune it carries out the inverse operation. This is how to sell or buy a stock back:

- go to your portfolio on the stock you bought/sold;

- select sell/buy and enter the amount or money you want to withdraw (you can also decide to partially disinvest);

- establish at what market cap price you want to return your investment;

- confirm the transaction and wait for the broker to execute the order.

How to Buy and Sell Amazon Stocks

Let’s take a concrete example. Suppose we want to buy Amazon shares, currently trading at [stock_market_widget type=”button-link” template=”link” color=”default” assets=”AMZN” url=”/link/amzn” target=”_blank” markup=”{currency_symbol}{price}” api=”yf”]. To do this we can choose to trade with a CFD broker such as eToro or Plus500 (to work with leverage).

Amazon Stock Trading Example

Click on Buy, decide the stop loss (the possibility of the stock being sold automatically if it falls below a certain limit) and take profit (automatic sale of the stock when profits are reached) margins and decide whether to buy the Amazon stock at the current market price or set a limit price for the automatic purchase of the stock.

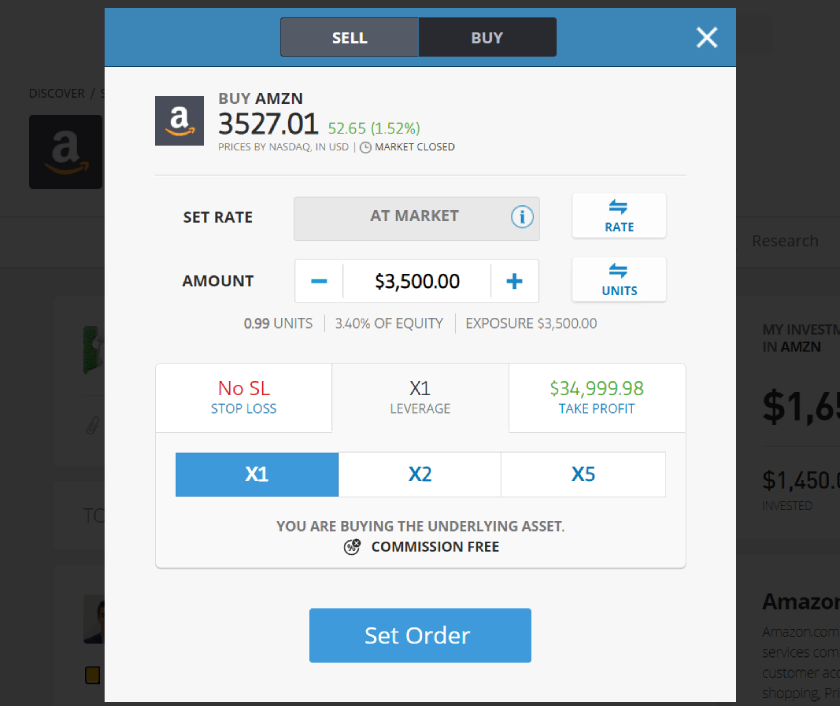

Buy amazon stocks with eToro

As you can see in the image on the right, this is the panel you see once you select the stock we want to invest in, in this case, Amazon (NASDAQ: AMZN).

A pop-up like this will appear, where you can enter:

- the amount we want to invest;

- the type of investment (sell or buy Amazon shares)

- The applicable Leverage (in the case of shares on the market it is x1, for CFDs it is x2, x5)

- The stop loss (by law set at least at -50% of the investment, but you can change it)

- Take Profit (the maximum profit limit before the automatic sale of the security).

- By clicking on “Open position”, you will have bought your Amazon stock.

Buying and Selling Amazon Stocks with Plus500 (CFDs Only)

If you choose the Plus500 trading platform then the popup that opens is very similar to the example below.

What you see below is a real-time chart that allows you to buy and sell shares with one click.

How do I sell stocks?

When you have decided you want to sell the shares you have in your securities portfolio, all you have to do is go to the relevant section (usually called ‘Portfolio’) and click on ‘Close Position’ and choose the amount you want to disinvest.

Buying shares intraday

CFD trading lends itself well to what is known as intraday trading, i.e. an investment that begins and ends within a single trading day.

By using the leverage mechanism, it is possible to maximise profits (also if profit are not guaranteed) by making short-term trades that can last as little as a few hours.

To buy and sell stocks in a day, study the performance of one particular stock. Focus on those that are attracting investors’ attention for one reason or another (release of quarterly figures, favourable or unfavourable political and social conditions, breaking news, etc.).

Assess whether the current picture will impact the stock positively or negatively, then decide when, how much and how to invest in that stock.

How much does it cost to buy and sell stocks?

There are several types of costs involved in buying and selling shares. The main one is trading commissions, which banks and some brokers charge for buying and selling shares. They can be dry or expressed as a percentage, increasing as the capital committed increases.

If you decide to buy shares quoted in a foreign currency (dollar, pound, yen) you are likely to incur currency conversion costs. Your trading account is denominated in euros, so you will have to convert your investment amount first and pay a small commission.

Finally, there are buy and sell spreads, which are the difference between the actual value of that stock and the cost to the investor. They vary constantly but usually do not go beyond a few percentage points (0.01%-0.5%).

Buying shares with a broker, however, allows you to lower these charges. EToro, for example, allows you to buy shares or CFDs at zero commission, while Plus500 offers the lowest spreads in the market on its CFDs.

The Impact of Current Market Trends

Understanding the Current Market Trends: As an investor, it’s crucial to stay updated with the current trends in the stock market. These trends, influenced by various factors such as economic indicators, geopolitical events, and company news, can significantly impact the performance of stocks. For instance, a positive trend in the technology sector might indicate a good time to invest in tech stocks. Conversely, economic instability could signal a potential downturn, suggesting that it might be a good time to sell or hold off on buying new stocks. By keeping a close eye on these trends and understanding their potential impact, you can make more informed decisions about when to buy or sell stocks, helping to maximize your investment returns.

How to Buy and Sell Stocks – FAQ

Choose a regulated broker and register for free. After you have practiced with your demo account, make a deposit (even with minimal capital) and choose which stock to buy or sell. When the stock is worth more than the purchase price, sell it back.

To buy or sell Amazon shares you need to choose an online trading platform that trades stocks or cfd’s, make a deposit and follow our short guide (Watch here)

Yes, by choosing a CFD broker. Contracts for difference are financial instruments that emulate the value of a substitute share. They are more liquid so you can trade intraday, buying and selling the share on the same day. Although depending on the instruments certain orders require a certain amount of available capital. One of the best CFD brokers is eToro.

Disclaimer This article is intended for informational purposes only and does not constitute an invitation to invest your own money or represent investment advice. For any further information, please contact your financial advisor.